Media 6: A World of Differences

“The E&M industry is getting used to the new normal – a multispeed market that expects and plans for disruption.” (p.19)

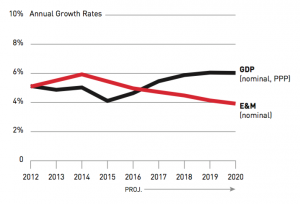

Chris Lederer and Megan Brownlow’s special report on global entertainment and media outlook is an in-depth projection of the future of Entertainment and Media (E&M) companies, highlighting five main shifts that are set to occur within the industry in the near-future.

I found the first shift detailed within the report to be particularly illuminating. According to Lederer and Brownlow, “n average, E&M spending in the 10 youngest markets is growing three times as rapidly as in the 10 oldest markets.” (p.11) Upon reflection, this seems to make perfect sense. It’s obvious that younger people, millenials, are the more frequent users of new technology within the broader society. As the report highlights, they “are more open to adopting digital behaviours – and therefore more open to digital spending.” (p.11) I make a big show of being technologically handicapped, but I’m just naturally more inclined to spend more elements of my life in the digital space than older generations, and this is reflected in my spending. Online purchases, streaming service subscriptions, the early adoption of new technologies – I’m all for it. The report asserts that “in younger markets … there will be a significant incentive for providers to shift completely to digital media…” (p.11) and I would have to agree. Millenials seem inclined to naturally adapt to the digital, and if providers pick up on this, I imagine it would be fairly good business.

Shifts 2 details the futility of relentlessly pursuing ‘global content’, arguing that “consumers decide at the local – and indeed personal – level what to purchase” (p.14) while the third shift emphasizes the importance of “flexibly priced” bundles available “on a full range of devices” (p.15).

The report’s fourth shift was another interesting one, focusing on growth markets and the problem of regulated content. As they explain, “regional inconsistency in regulation and market access affects business models, the shape of the market, and the revenue outlook in different territories.” (p.16) The argument is that a uniform global strategy is just not applicable when you have certain markets that heavily censor and control the content that is screened in the country. Again, like last week’s readings, the writers appear to be highlighting the value of adaptability in this new age of rapidly evolving technology. Companies must adapt to “heavily regulated markets” (p.16) or risk falling behind.

The report concludes with the assertion that “companies that combine these attributes and establish positions in high-growth markets will be the most likely to succeed” (p.19) but that seems easier said than done. However, while last week I derided government entities for their proven inability and/or unwillingness to adapt, the E&M industry does generally seem to want to keep up.

Recent Comments